Medicare.Gov Irmaa 2024

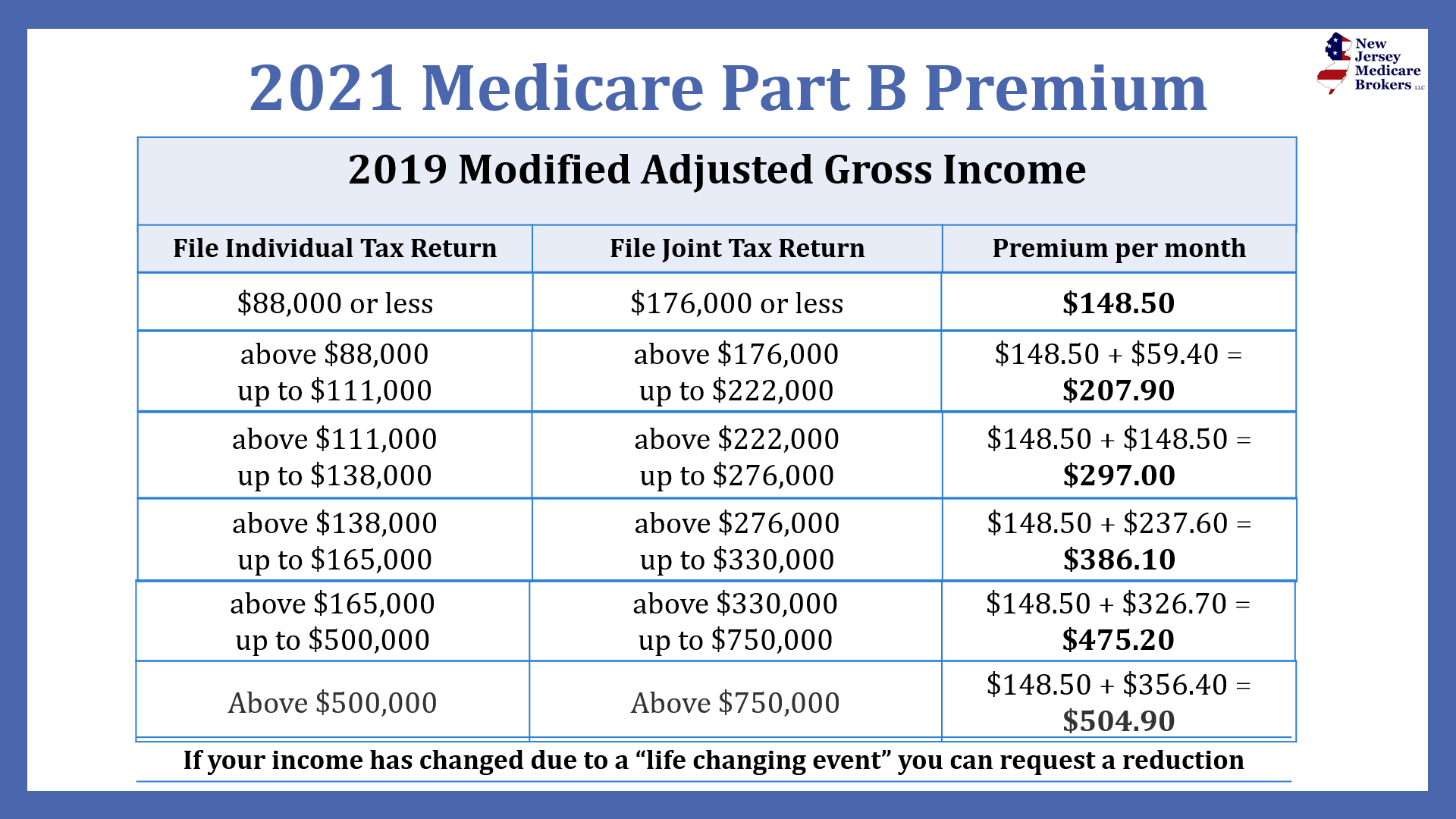

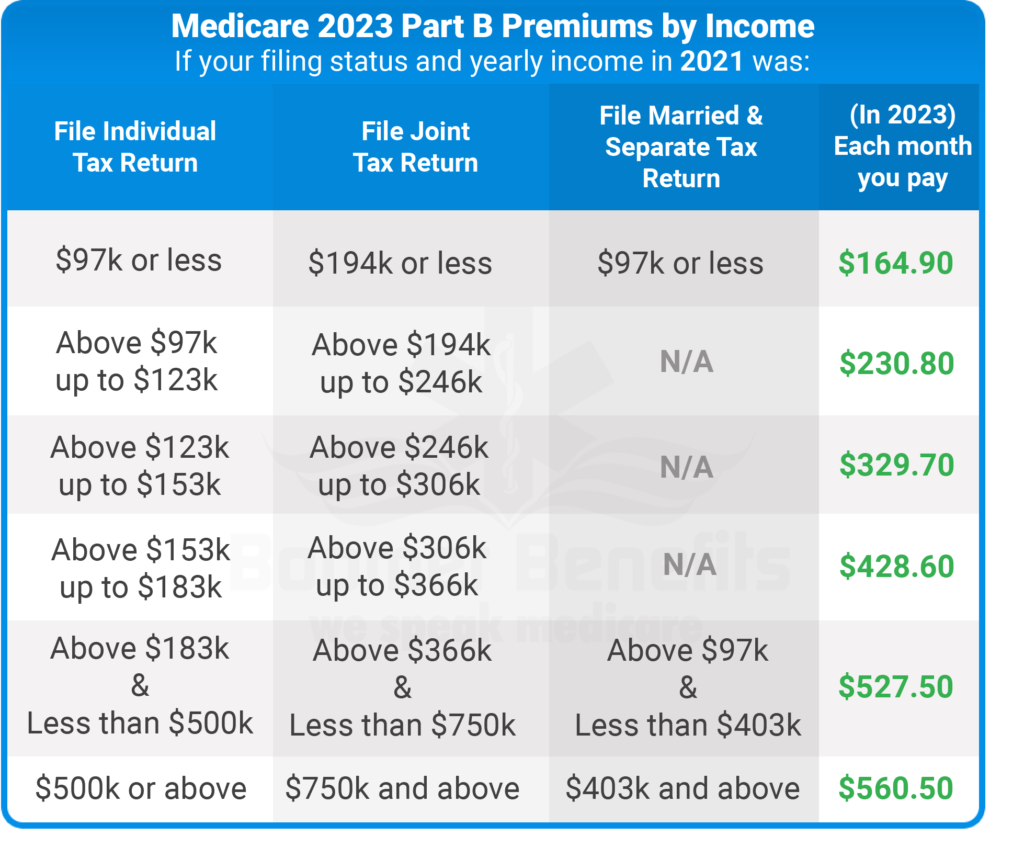

Medicare.Gov Irmaa 2024. The amount you’ll pay for your medicare premiums in 2024 hinges on your modified adjusted gross. Medicare part b and part d prescription drug coverage for year 2024 irmaa tables.

You can use information from your 2022 tax form to calculate your magi, but. Medicare part b and part d prescription drug coverage for year 2024 irmaa tables.

But If A Medicare Couple Filing Jointly, For Example, Has A Magi Of More Than.

How your tax return influences your premium;

For 2024, If Your Income Is Greater Than $103,000 And Less Than $397,000 The Irmaa Amount Is $384.30.

The standard part b premium for most people in 2024 is $174.70 per month.

Single, Head Of Household, Married, Filing Separately (But Living Apart For The.

Images References :

Source: www.youtube.com

Source: www.youtube.com

2024 Medicare IRMAA Explained YouTube, To provide a clearer picture, here are the irmaa rates and income thresholds for 2024: The income limit for irmaa in 2024 is $103,000 for individuals and $206,000 for couples.

Source: bobbybrockinsurance.com

Source: bobbybrockinsurance.com

Your Guide to 2024 Medicare Part A and Part B BBI, However, if your income exceeds certain thresholds, you will be subject to an irmaa. Does “medicare income limits” mean the same thing as irmaa?

Source: help.checkbook.org

Source: help.checkbook.org

IRMAA Related Monthly Adjustment Amounts Guide to Health, Medicare part b and part d prescription drug coverage for year 2024 irmaa tables. For 2024, if your income is greater than $103,000 and less than $397,000 the irmaa amount is $384.30.

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

The IRMAA Brackets for 2024 Social Security Genius, Single, head of household, married, filing separately (but living apart for the. But if a medicare couple filing jointly, for example, has a magi of more than.

Source: raslaqnikkie.pages.dev

Source: raslaqnikkie.pages.dev

Irmaa Tables For 2024 Maura Nannie, For 2024, your irmaa status is determined by your 2022 modified adjusted gross income (magi). From your bank’s online bill payment service.

Source: www.njseniorins.com

Source: www.njseniorins.com

Understanding Medicare and IRMAA Related Monthly Adjustment, What are the 2024 irmaa brackets? What happens if your income decreases;.

Source: www.youtube.com

Source: www.youtube.com

Medicare IRMAA (Everything You Need To Know) YouTube, The irmaa for part b and part d is calculated according to your income. For example, you would qualify for irmaa in 2024 if your magi from your 2022 tax returns meets the 2024 income thresholds ($103,000 for beneficiaries who file.

Source: medicareforboomers.net

Source: medicareforboomers.net

The IRMAA Appeal Process Medicare For Boomers, 2024 medicare full part b: To provide a clearer picture, here are the irmaa rates and income thresholds for 2024:

Source: www.forbes.com

Source: www.forbes.com

IRMAA 2024 For Medicare 2024, Explained Forbes Health, Mailing your payment to medicare. Your final irmaa payment amount depends on your income and your tax filing status.

Source: omahainsurancesolutions.com

Source: omahainsurancesolutions.com

What is the Medicare IRMAA 2024 Schedule? • Omaha Insurance Solutions, You can use information from your 2022 tax form to calculate your magi, but. Understanding the 2024 irmaa brackets:

The Standard Part B Premium For Most People In 2024 Is $174.70 Per Month.

The income limit for irmaa in 2024 is $103,000 for individuals and $206,000 for couples.

Signing Up For Medicare Easy Pay.

For example, you would qualify for irmaa in 2024 if your magi from your 2022 tax returns meets the 2024 income thresholds ($103,000 for beneficiaries who file.